Investing Tools to Grow Your Money

Investing lets your money work for you, even while you sleep. To truly grow wealth, consider the path of successful individuals who invest in businesses, stocks, or assets. Find your opportunity and let your money grow.

Bitcoin$108,948.000.75%

Ethereum$2,561.171.77%

Tether$1.00-0.01%

XRP$2.262.02%

BNB$661.340.82%

USDC$1.000.00%

Dogecoin$0.1709264.13%

Cardano$0.582.19%

Investing and making money  isn’t complicated, but it is a skill that requires making some informed

isn’t complicated, but it is a skill that requires making some informed  decisions.

decisions.

Acquiring that skill means learning from people who have been successful on the journey so you can observe what works and what doesn’t. It also means practicing these skills and improving on them over time as you gain real-world investing experience.

Our investing tools can help you do that

Our tools show you how much your account can grow given a specified percentage return. This allows you to plan your capital growth, have targets to aim for, and keep you motivated instead of just “hoping” some random trades will work out.

Our investing calculators allow you to see what’s possible, while the additional tools below help you reach those goals.

Convert and Track Values Instantly

Crypto calculators show you conversion rates between various crypto currencies. Want to convert your Bitcoin or Ethereum to another coin, or vice versa?

Our real-time cryptocurrency calculator shows you up-to-date information to keep track of different coins’ values compared to fiat currencies.

Expert Insights, Guides, and Videos for Success

Crypto investing insights, guides, and videos reveal what you need to know to get started and thrive while crypto investing, whether you’re starting out or have been trading Bitcoin since it was a dollar. It now trades north of US$10,000 and reached as high as US$65,000 – wide price swings to profit from.

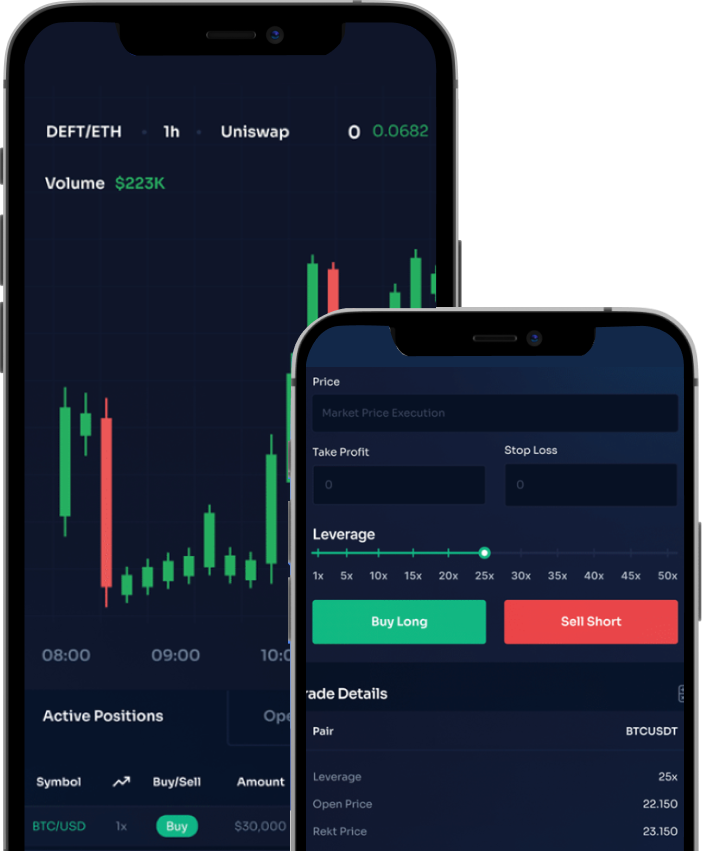

Master Chart Analysis for Successful Trading

Our charts show how various asset prices are moving. Technical analysis using charts allows you to find recurring patterns which can be exploited to make recurring profits. Many successful traders and investors rely on charts for making their trading decisions. We will show you how to use them.

Uncover Profitable Opportunities with Artificial Intelligence

AI forecasts highlight money-making opportunities. Artificial intelligence has the ability to find patterns and solutions to problems which may go unnoticed by the human mind. It is an additional tool you can utilize to find investing opportunities you may not have thought of otherwise. It’s a great way to augment your existing investing skills.

Expert Insights, Strategies, and Stories for Success

We provide guides which examine specific investing topics. These investing guides show you what works and what doesn’t. Market experts provide their market experience, their stories, and their favorite investing strategies and insights.

Engaging Videos with Expert Insights and Strategies

Our videos provide a quick and visual way to learn about investing. They include key insights from investing experts and highlight investing concepts which empower you to make better financial decisions. Our videos cover a wide range of topics from the basics, to risk management, to strategies that outline when to put your money in and when to take it out.

Choosing the Right Brokers

Reviews break down which brokers are reputable to work with and which aren’t. Our tools help you get started, or keep you on a path of investing success. On that topic, below are tips to get you started on your investing, whether it is in crypto or stocks.

How to Get Started with Investing

There is no set minimum on how much you need to get started, but better to jump in sooner rather than later. As a general rule, the longer money is invested the better the returns are due to compounding.

If you invest $10,000 this year and it makes 10%, that’s $1,000. You now have $10,100 in the account. If you make 10% the next year, you make $1,100.

Your profits grew, even though you did nothing extra and you made the same return. Next year you have $12,100 and you make $1,210. The income continues to grow because the return is on a larger and larger amount of money.

This is why it is good to start as soon as possible; it is never too late. The longer an investment can make a good return, the greater the compounding effect over time.

Opening a trading account is the first step. The type of account that’s best for you depends on whether you want to invest in stocks or crypto. Stocks have produced long-term returns of 10% per year over the last 100 years. Crypto is a newer asset without the lengthy track record of stocks. Standard and Poors (S&P) has indices which track the performance of crypto assets, and over the last five years crypto assets have generated 18.27% yearly returns (as of Nov. 11, 2022).

How to Use Investing Calculators

We offer a number of investing calculators on Investing.biz. These calculators make it quick and easy to calculate expected returns, determine how much of an asset to buy, or how much you’ll get converting one asset into another.

See how much your investment will grow over time. Input your investment amount, your expected rate of return per year, and how long you will be holding the investment. Try out different scenarios.

The calculator reveals the possible future account balance if you attain the return specified. Dig into investing strategy articles to learn ways to make that return a reality.

Crypto-Currency Conversion

See how much of one crypto coin you can get for exchanging another

Input the crypto investment you would like to exchange, and how much. Then select the crypto investment you would like to receive in exchange.

The calculator will show you the current exchange rate between the two currencies, and how much of one you can get for the other.

Position Size Calculator

A position sizing calculator shows you how much of an asset you should buy for a chosen level or risk. This can be especially useful if you want to limit any potential losses to a defined percentage of your account.

If you don’t want to lose more than 1% on the account on a single trade, that doesn’t mean you only put 1% of your capital into a trade. You could put all your capital into that trade, but you get out if it drops 1%, for example. Or you may put a portion of your funds into the trade, and get out if the price drops 5% or 10%.

The position sizing calculator tells you much to buy based on how much of your account you are willing to risk and where you plan to get out of the trade if it doesn’t work (called the stop loss).

Whatever you are planning to risk, your potential profit should be more. For example, if you specify that you are willing to lose 1% or a certain dollar amount, don’t take the trade unless reasonably expect two or three times (or more) that amount if the trade wins.

Getting Started with Crypto Investing

Crypto investing has provided triple and quadruple percentage gains in some recent years. Looking at a wide array of crypto assets, the average yearly return is 18% over the last five years according to S&P, as discussed above.

Crypto provides investment returns, but the short-term fluctuations are also tradable.

To start trading or investing in crypto requires a “wallet”. A crypto broker such as Coinbase provides you with a wallet which is in their custody. You can also get a “hard wallet” which is similar to a USB drive that you store your crypto assets on.

A broker-controlled wallet is an easier choice when starting out. If you accumulate a sizable amount of crypto investments, investing in a hard wallet is worth the money, since they start at about $100.

You can upload funds into your account by linking your bank account and depositing US dollars (or whatever currency you use) to your crypto account.

In your crypto broker account, click the buy or sell button to start a transaction. Select the asset you would like to purchase. Choose how much you would like to buy. You’ll see a conversion displayed showing how much of that cryptocurrency you can buy for the amount of US dollars (or other currency) you are willing to invest.

Buying, selling, sending, and receiving funds is subject to a “gas” fee. It is usually a small amount of the transaction which is paid to the people who are providing services on the blockchain.

What Is A Dividend?

In this article, we cover the basics you need to know about dividends and elaborate on the types of companies that pay them — or don’t pay them.

Read this article

Different Types Of And Taxes On Dividends

Our guide on the different types of dividends takes you through these practical, yet critically important considerations when investing in stocks that pay dividends.

What Is Dividend Growth Investing?

With an understanding of DGI as a portfolio strategy, you can up your long-term investing and retirement planning game.

Our guide to dividend growth investing illustrates how it can generate impressive investment returns.

Is Investing Regulated?

Regulation means there is a governing body trying to make sure that investments are not fraudulent.

There are regulatory bodies around the world, in various countries, doing this.

The stock market is highly regulated in all first world countries. When you buy a stock, that company has had to jump through a lot of hoops to get listed on a stock exchange. To stay listed on the exchange (so the public can trade it) they need to regularly provide financial statements and provide investors with updates on how they are doing. If they lie, the penalties from regulators can be severe.

Crypto investing is largely unregulated because it operates outside the main-stream financial system. While regulators will crack-down on outright fraud, since crypto assets can be used

globally it can be difficult for any single country’s regulators to track down or charge fraudulent companies or individuals with wrongdoing. In the US, the Securities and Exchange (SEC) commission pursues individuals and organizations who are operating frauds in cryptocurrencies. US-based crypto brokers are required to operate under US laws, but of course this is only a portion of the crypto market. Once you have a wallet, you can send crypto to anyone else with a wallet, anywhere in the world. If someone convinces another person to send them crypto, under false pretenses, that money is unlikely to be retrieved. Just like you wouldn’t hand over paper money to just anyone, don’t send crypto to unverified sources.

In the US, the Securities and Exchange (SEC) commission pursues individuals and organizations who are operating frauds in cryptocurrencies.

US-based crypto brokers are required to operate under US laws, but of course this is only a portion of the crypto market. Once you have a wallet, you can send crypto to anyone else with a wallet, anywhere in the world. If someone convinces another person to send them crypto, under false pretenses, that money is unlikely to be retrieved.

Just like you wouldn’t hand over paper money to just anyone, don’t send crypto to unverified sources.

How To Receive Dividend Income Every Month

Learn the main ways you can receive dividend income every month, all year round, with detailed instructions and examples on how to construct a portfolio with monthly dividend income.

What Are Dividend Aristocrats?

Learn what a dividend aristocrat is as well as other classifications of dividend stocks with examples of companies that have achieved dividend aristocrat status and how and why you might want to invest in these potentially lucrative income stocks.

What Is Dividend Payout Ratio?

Learn about dividend payout ratio, a key metric you need to know because it measures the sustainability of a company’s dividend payment.

Why Choose Investing.biz?

Learn from winning traders and investing professionals who have been featured in high-end financial publications and websites.

Our authors provide no-fluff investing strategies and advice. See their profiles and their latest articles below.