What Is Dividend Payout Ratio?

Companies can do several things with their earnings, but the two most popular options are:

- Reinvest their profits in the business.

- Return a portion of earnings to shareholders, often via regular dividend payments.

This guide focuses on the latter, exploring a metric many investors overlook: payout ratio.

Payout ratio shows the percentage of its net income a company pays out to shareholders in dividends. Understanding and applying dividend payout ratio can give you a leg up on investors unfamiliar with the concept.

By the end of today’s guide, you’ll be able to calculate payout ratio, use it to research dividend stocks, and tell the difference between good and bad payout ratios.

Dividend Payout Ratio: Calculation

To calculate dividend payout ratio, simply divide total dividends paid by net income:

Payout ratio = total dividends paid / net income

While it’s straightforward in theory, you must consider several factors when assessing dividend payout ratio.

We will deconstruct a few examples so you can gain an understanding of these factors and learn how to tell a good payout ratio from a not-so-good – or flat-out bad – payout ratio.

Dividend Payout Ratio Example

Keeping it simple: if a company had $100 million of net income in a year and returned $50 million of that profit to shareholders as dividend payments, it has a payout ratio of 50%.

50% = $50 million / $100 million

Of course, when you make this calculation, you have to do some basic math.

Dividing $50 million by $100 million results in 0.5. To get the percentage, move the decimal point over two places to the right. This is how we get to the 50% dividend payout ratio in this hypothetical example.

Dividend Payout Ratio: The Good, the Bad, and the Ugly

How can we discern a good dividend payout from a bad one?

As a baseline premise, a dividend payout ratio higher than 50% is a potential warning sign. While a payout ratio this high isn’t always an issue, it can be.

Therefore, it warrants further investigation.

Most payouts lower than 50% are solid. A company with a low payout ratio might be holding back a significant portion of its earnings – a potential good sign, suggesting further revenue and profit growth lies ahead alongside significant potential for consistent and robust dividend increases.

Dividend Payout Ratio: Good Example

Apple (AAPL) is one of the stock market’s best examples of a good and strong payout ratio.

To find the numbers you need to calculate dividend payout ratio, you have to do some digging. Luckily, many online platforms that provide detailed stock quotes have a dividend tab that often includes payout ratio, saving you time and effort.

Though you have all that information at your fingertips, you still need to make sense of it. Let’s run through the long way of getting the information you need to calculate payout ratio to best illustrate the concept.

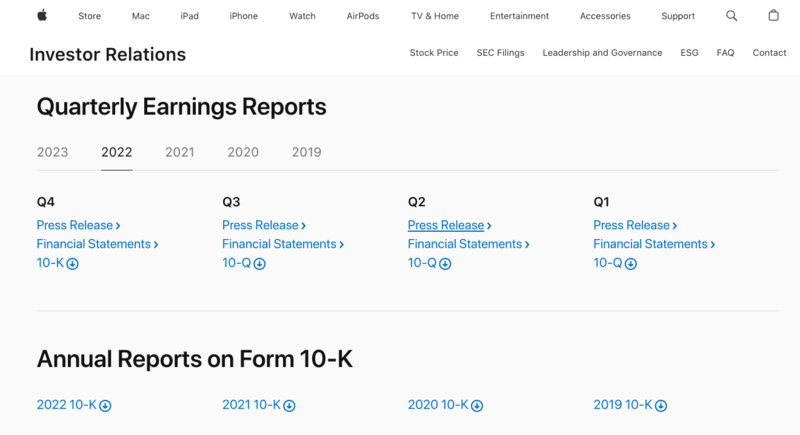

First, you need to access the company’s annual report. As seen below on Apple’s Investor Relations website, most companies make these forms easy to find. Just look for a tab that is labeled with SEC (Securities and Exchange Commission) filings, earnings, or something similar.

For our purposes, we selected Apple’s 2022 10-K (which is the official name for the annual report all public companies must file with the SEC). Most investor relations’ websites link you directly to the SEC to access this info.

Once inside the annual report at the SEC website, use CTRL+F on your keyboard to find “net income.”

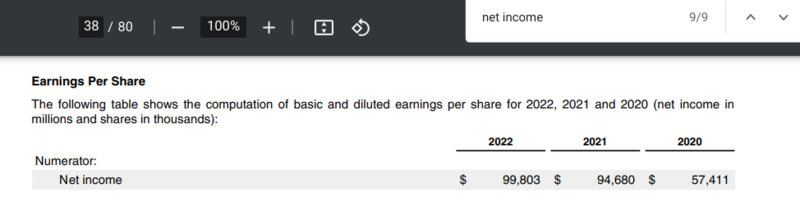

As you see, Apple’s net income for 2022 was $99,803,000,000. That’s right: $99.8 billion, with a “b”.

As you see below, a search for “dividends” in the same annual report reveals the total dividends paid in 2022, conveniently alongside net income, just in case you couldn’t find it initially.

In 2022, Apple paid out a staggering $14.79 billion.

Plug these numbers into the dividend payout ratio formula and you come up with this:

14.8% = $14,793,000,000 / $99,803,000,000

Apple’s payout ratio for 2022 was an objectively impressive 14.8%.

While it’s nice to know how to find the data to calculate the payout ratio yourself, it is sometimes better to use data from a detailed stock quote. This will often estimate a forward-looking payout ratio based on the current dividend payment and anticipated earnings for the present year.

Apple’s payout ratio strongly suggests two things:

- Apple pays a sustainable dividend.

- Apple has plenty of room to continue increasing its dividend and maybe even increase the increases.

Apple held back roughly $85 billion of its net income in 2022 to operate and reinvest in its business, among other related uses of this capital. Given this cushion, Apple can afford to not only pay its present dividend, but continue to increase it.

As of April 2023, Apple has increased its dividend every year for the last 11 years. Given its financial positioning, Apple is a company that will probably become a dividend aristocrat one day.

As dividend aristocrats are companies that have increased their dividends for at least 25 consecutive years, Apple is on track to get there in about 14 years.

Dividend Payout Ratio: Bad Example

If you see a negative payout ratio, run.

A negative payout ratio can mean several things. The two most likely scenarios:

- A company is losing, or is about to lose, money, meaning it will cut or eliminate its dividend. Because, generally speaking, a company without profits probably shouldn’t be paying a dividend.

- The company is relying on cash on hand, debt or some way other than using net income to fund its dividend – also a warning sign.

If you stick to dividend aristocrats and other quality dividend-paying companies, you will not have to worry about negative payout ratios.

Dividend Payout Ratio: Exceptions To The Rule

At first glance, Procter & Gamble’s (PG) 2022 payout ratio of 57% and its anticipated 2023 payout ratio of 59% seems high. (To get these numbers, we used data from PG’s 2022 annual report and its April 2023 quarterly report). This should not be a major cause of concern for investors.

PG is a dividend aristocrat, having increased its annual dividend payment every year for 67 years. Over the last five years, as of April 2023, Procter & Gamble has increased its dividend payment by, on average, 5.6%. The company has a lengthy track record of not only paying, but increasing its dividend.

As a consumer staples company, Procter & Gamble doesn’t require as much cash to run its business as a more aggressive growth tech company such as Apple.

For example, in 2022, P&G spent roughly $2 billion on research and development compared to Apple’s nearly $26.3 billion. You can also find this data in a company’s annual and quarterly reports.

Different business, different uses of cash – different dividend payout ratio expectations.

When you look up a REIT (real estate investment trust) you will find high payout ratios. You will commonly see REITs, such as dividend aristocrats Realty Income (O) and Federal Realty Trust (FRT), sporting payout ratios in the 200% range. Generally, this is not a cause for concern.

Long, complicated story short… REITs own real estate. These properties generate cash flow, however when REITs account for their holdings they can write off the depreciated amounts of these holdings, thereby the net income they report is artificially low. However, the cash flow – and ample cash – to pay the dividend is there.

Couple this with the fact that SEC and IRS regulations mandate REITs return 90% or more of their taxable income to shareholders using dividend payments and you get these high payout ratios.

FAQs

I read that Apple has used debt to pay its dividend. How can this be okay?

It’s true. From time to time Apple sells bonds – a form of debt – and uses the proceeds to fund its business. That includes dividend payments. This is common and not a cause for concern.

Companies often take advantage of low interest rates, sell bonds to investors and pay a relatively small premium to the bondholders. The return a company like Apple generates more than makes up for the cost of the debt.

Of the dividend aristocrats, which payout ratio is most concerning?

IBM (IBM) has paid a dividend for 27 consecutive years. Its payout ratio hovers around 66%. This is, in part, because of declining earnings.

While IBM has plenty of cash on hand to cover the dividend, it makes sense to keep an eye on the business to ensure its dividend stays strong and keeps increasing. (Data gathered from IBM’s most recent annual and quarterly reports).

Other than payout ratio and dividend increases, what should I look for?

When assessing dividend stocks, always look at the dividend yield. Our guide to dividend yield tells you what it is how to evaluate low and high yields.

My friend says Tesla and Amazon will never pay dividends. Is this true?

While there’s no way to know for sure, remember that people once said the same about Apple. It’s all about balancing growth and income. Plus, some companies’ stock price appreciation more than makes up for the lack of a dividend payment.

Our guides on growth and income stocks and the best stocks to buy for dividend growth and income dives deep into this important question.

Of the dividend aristocrats, which has the lowest payout ratio?

As of April 2023, it’s Roper Technologies (ROP) at 6.7% for 2022 and 15.7% for 2023. Over the last five years, the company’s stock has gone up by roughly 66%. Revenue and profits are also on the rise. ROP is a good example of a balanced growth and income stock. (Data gathered from Roper’s recent annual and quarterly reports).

Conclusion

Dividend payout ratio helps you evaluate the sustainability of a company’s dividend payment because it shows the percentage of its profits it pays out to shareholders via dividends. While the general rule of thumb is to be wary of payout ratios greater than 50%, a higher number is not always cause for concern.

Payout ratio is just another tool to use in your research. Coupled with other quantitative and qualitative factors, it can help you not only gauge sustainability, but if a company has enough net income to continue increasing its dividend.