Use our investment calculator to quickly and easily see amounts and time frames that

will help

you reach your investment targets. The available features include:

Investment Calculator for Calculating

Returns and Total Dollar Amounts

End Amount Calculator :

See your ending balance given a specified starting balance and stated return.

Investment Length :

See how many years you need to contribute to your investments in order to reach your desired wealth.

Return Rate :

See the return you need to reach your nest egg goal.

Additional Contributions :

See how much you need to contribute each month to reach a desired ending balance.

Start Amount/Initial Investment :

See how much capital you need to start with to reach your retirement or savings goals.

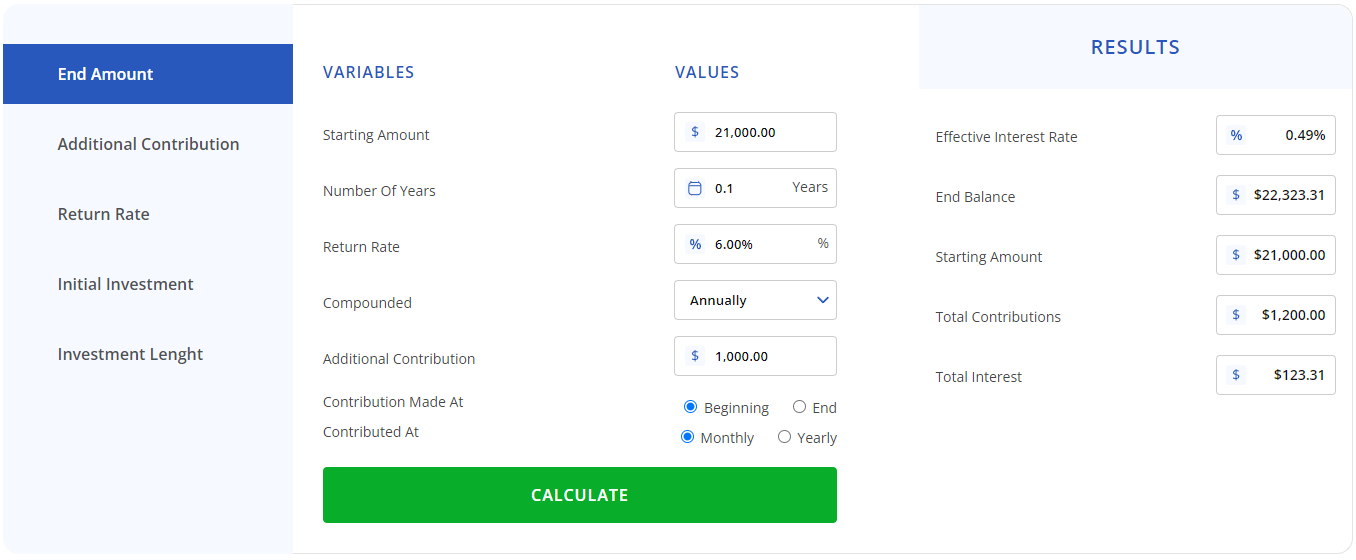

End Amount Input and Output Fields

Here’s how the End Amount Investment Calculator works, and how to

interpret the data it gives

you.

Starting Amount :

This is the amount of capital that you have to contribute to your investments right now (or when you start investing).

Return Rate :

This is your expected return on investment. For reference, the S&P 500 index has returned 10% per year over the last 100 years. You can also think of this as an interest rate you are receiving.

Additional Contributions :

Contributions are the additional amounts of capital you will add to your investments each month or each year – the payments you will make.

Contributed At :

Choose monthly or yearly based on how often you will be making additional contributions to your investments. Increasing contribution frequency will increase your overall ending balance.

Number of Years :

This is how many years you plan to invest.

Compounded :

This is how often your return rate compounds. Most investments will be compounded yearly since you only get that return once per year.

Contributions Made At :

Choose the beginning or end. Beginning means you are making your contributions to your investments at the beginning or end of the month/year. Making contributions at the beginning of a period will increase your overall return since the money is gaining a return for longer.

Compounded :

This is how often your return rate compounds. Most investments will be compounded yearly since you only get that return once per year.

Click “Calculate” once you have filled in all the fields. If

you don’t know a specific

number, input an estimate, or try various scenarios to see how

it affects the results.

Under the Results, you will see the following fields. Here’s what they mean:

Effective Interest Rate:

This is your return per contribution interval. If you contribute yearly, it will be similar to your Return Rate. If it is monthly it will be a smaller amount since you are getting partial returns on your capital as you contribute throughout the year. See the Effective Interest Rate calculator for more on this.

Starting Amount :

This is the amount you started with (for reference). It is the same as the Starting Amount in the input field.

Total Interest :

This is how much you made on your investments, over and above your contributions and Starting Amount.

End Balance :

This is the most important figure as it tells you how much your investment portfolio will be worth at the end of the number of years you selected.

Total Contributions :

This is the total amount of money you added to your investments over the number of years (doesn’t include the starting amount).

The chart above shows an example of starting with $10,000 and investing

over 20 years. The

calculation assumes an average yearly return of 7% compounded annually, with additional

contributions at the start of each month for $1,000.

Given this data, the ending balance in the account is expected to be

$549,102.91. Over and above

the

starting balance and contributions, your investments made you $299,102.91.

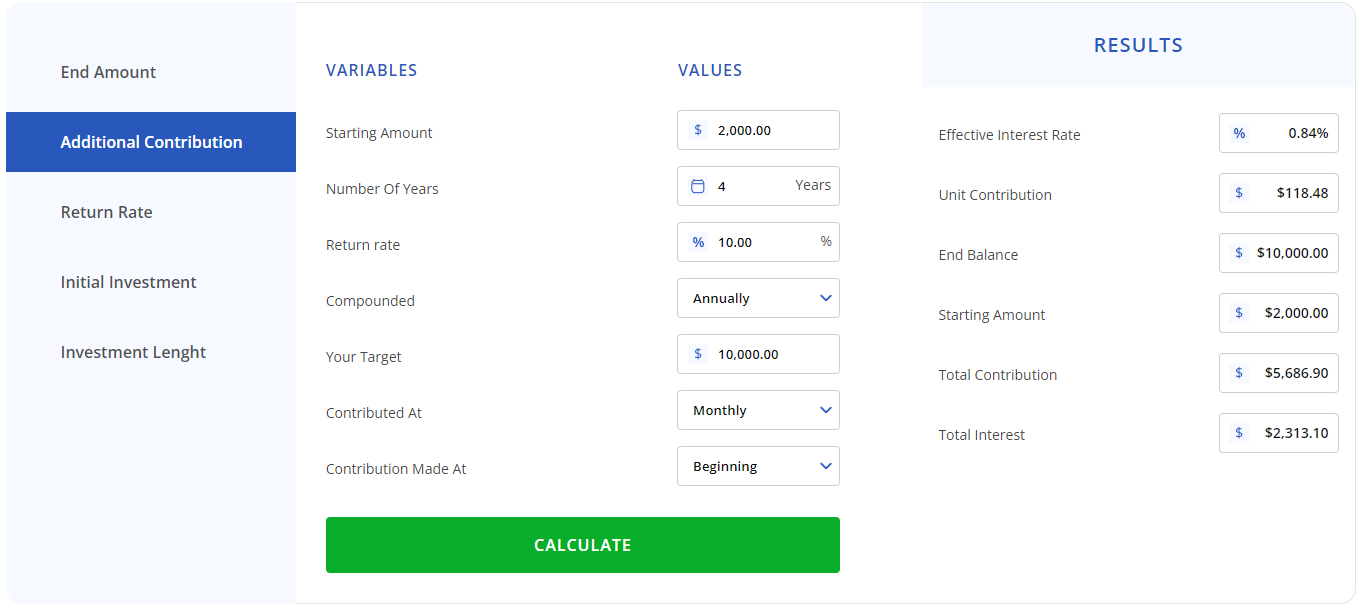

Additional Contribution Input and

Output Fields

Use this calculator to see how much your monthly or yearly contributions

should be to reach an investment goal.

Starting Amount :

How much capital you have to put into your investments now (or when you start investing).

Return Rate :

Your expected rate of return on your investments.

Your Target :

How much capital you want to have at the end of the investment horizon.

Contribution Made At :

Whether you will be making your contributions at the beginning or end of the month or year.

Number of Years :

How many years you plan to invest. This is often referred to as the “investment horizon.”

Compounded :

How often your gains are compounded. Typically, they are compounded yearly.

Contributed At :

Whether you will make additional contributions monthly or yearly.

Click “Calculate” to see your results. Here is what the results mean:

Under the Results, you will see the following fields. Here’s what they mean:

End Balance :

How much you have at the end of the number of years. It will match your goal.

Total Contribution :

The total amount of money you invested each month or year.

Total Interest :

How much money your investments made over and above contributions and starting balance.

Starting Amount :

The amount you started with.

Unit Contribution :

How much you need to contribute to your investments each month or year (depending on what you selected above).

Effective Interest Rate:

Your return per contribution period.

Below is an example of the Additional Contributions calculator assuming a goal of reaching

$100,000

within 10 years based on a $2000 starting balance, 10% return, and making

contributions each

month

(beginning).

The contribution required per month is $470.63 to reach that goal.

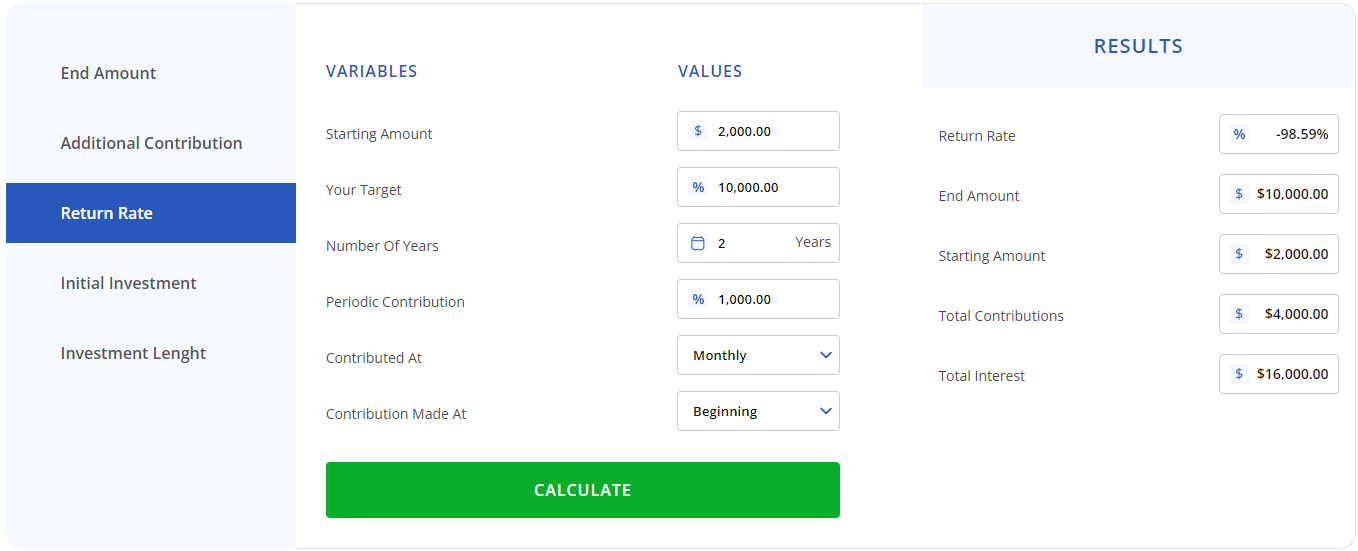

Return Rate Calculator Inputs and

Results

Use the Return Calculator to see the rate of investment return you need in

order to reach a

desired portfolio ending balance.

The return rate has same input field as other calculators,

except the return rate has field

is left out. It will be calculated for you based on your target, starting balance, and

contribution

Under the Results, you will see the following fields. Here’s what they mean:

Here is an example. Let’s assume you have $2,000 now, but you want to grow your savings to

$10,000 in

two years. You can afford to contribute $300 at the end of each month.

Inputting this data, your investments will need to return at least 6.97% per year in order to

reach

your goal of $10,000. You will have contributed $7,200, you started with $2,000, so your

investments

made you $800 over and above those amounts.

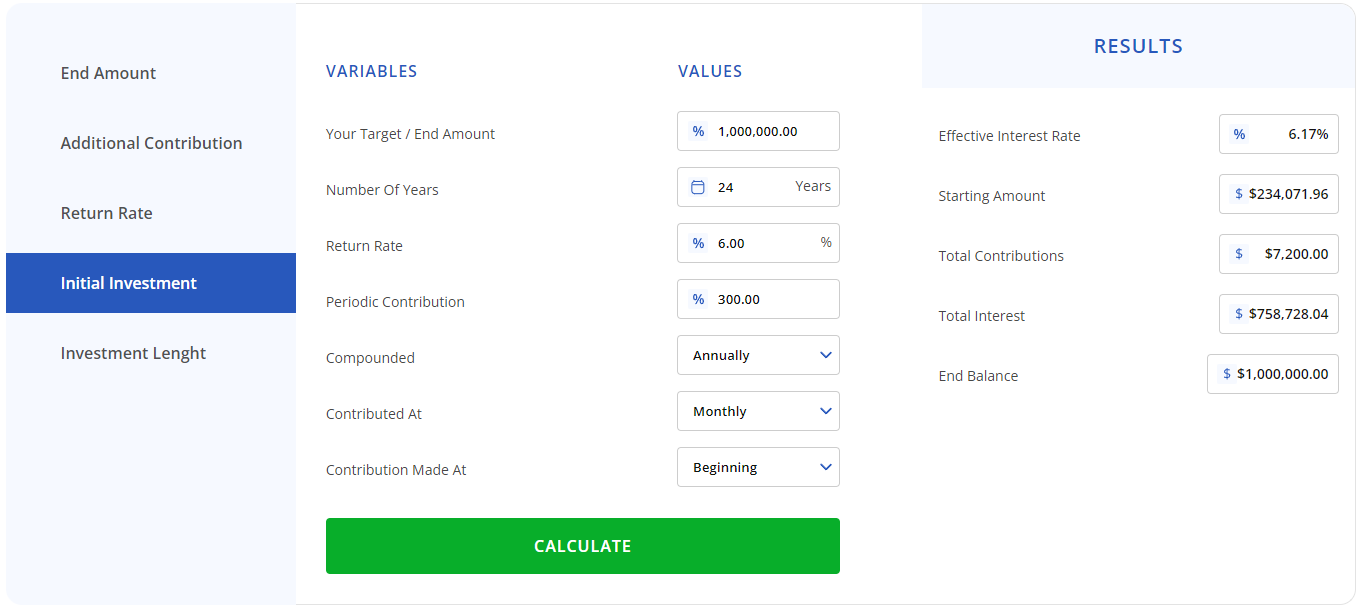

Starting Amount and Initial

Investment Calculator

Use this calculator to figure out how much you have to start with in

order

to reach a desired ending balance based on a given rate of return and

contributions.

All the input fields are the same on this calculator as the

others. Consider your ending balance and

how much you can afford to contribute each year

or

month. Also, consider your expected rate of

return. Clicking “Calculate” will give you the

Starting Amount required to reach your investing

target.

For example, let’s say you want to reach a goal of $1 million in 30 years. You

assume you can

make

6%/year on your investments and can contribute $1,000 at the beginning of each month.

According to our results, your required starting balance is $3,611.66 in order to reach this goal.

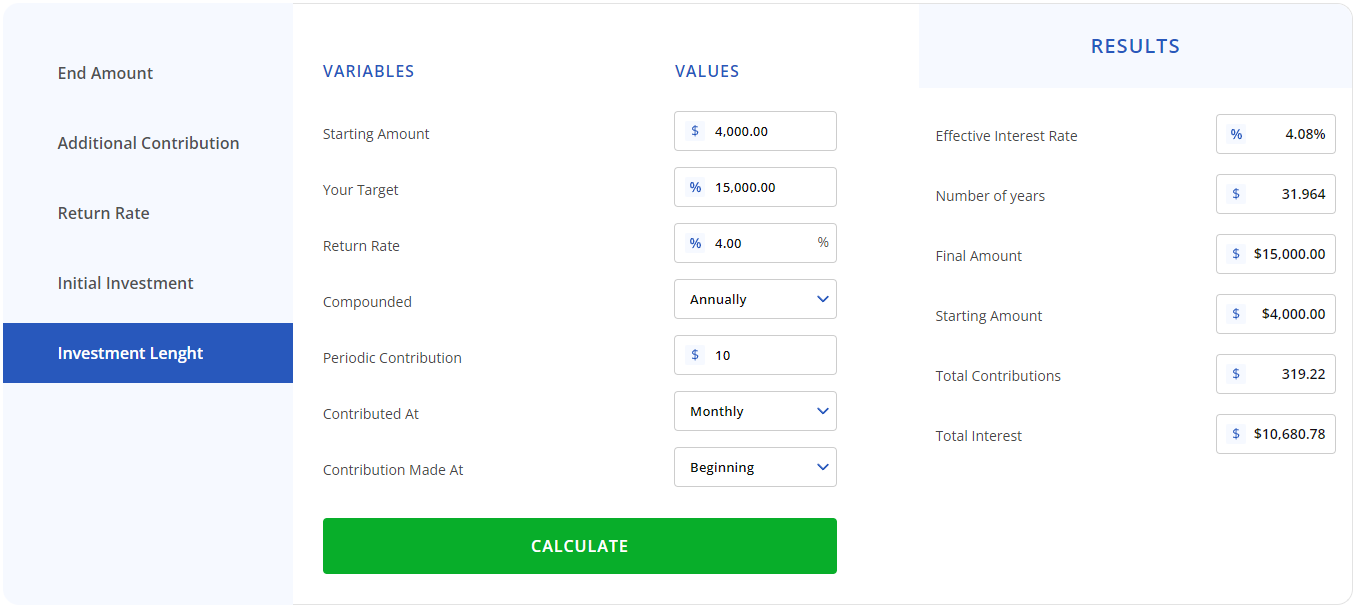

Investment Length Calculator

Example

Use the investment length calculator to determine how long you need

to

invest and make contributions in order to reach a desired portfolio ending

balance

Most of the input fields are the same as the other

calculators, except you don’t need to input your

Number of Years. This is calculated for

you.

Your Period Contribution is the dollar amount you can contribute each month or

year.

Assume you have $4,000 now and have a goal of reaching

$15,000. You believe

you can get 8%

investment returns and can afford to contribute $100 at the beginning of each

month.

In the results, you can see that it will take 5.778 years in order to reach

your goal. That equates

to

just over 5 years and 9 months (0.778 x 12 months).

FAQ

here is the answer to your yours question.

What is a typical rate of return on stocks?

Stocks have averaged a yearly return of 10% over the last 100 years. This is based on the S&P 500 index which tracks the largest 500 stocks in the United States. It is an average, which means that if you only invest in a few stocks your returns could be quite different. The top-performing stocks have returned thousands of percent over multiple years, while the worst-performing stocks go to zero.

What is the typical rate of return on bonds?

Bonds tend to be less volatile than stocks and have also produced lower average returns. The average bond return over a 30-year period is 6.1%, while stocks averaged 10% yearly returns. Bonds are better for those with a lower risk tolerance. You can invest in bonds through exchange traded funds (ETFs), mutual funds, or buy bonds directly.

How much should I invest to have $1 million at retirement?

This will largely depend on how long you have until retirement. Assuming you have 30 years until retirement, you will need to contribute $700 per month at a return of 8% in order to reach $1 million at the end of the 30 years.

What are the best investments in terms of returns?

Stocks are one of the best investments that are easy to buy and sell. U.S. stocks have returned 10% per year over the long run. Bonds are considered less volatile and have returned 6% over the long run. Real estate can also be a great long-term investment averaging 10% returns. Farmland is slightly better at 11% per year.

How much interest does $100,000 earn in a year?

In a savings account, $100,000 may earn 3% interest. Interest is typically compounded monthly so you make money on interest already earned. Therefore, you will make slightly more than $3,000 ($3,041). If you can earn 5%, you will make just over $5,000 ($5,116) after compounding.

Final Thoughts on Using Investment Calculators

Investment calculators are useful for figuring out exactly how much you need to contribute each month to reach a goal, or the starting capital or rate of return you need. It can also be used to show how long you need to invest to get your desired ending balance.

While you can try out different scenarios using random numbers, to get the most accurate results, spend some time thinking about your financial situation, what you can actually afford, and a rate of return that is realistic.

If you want to figure out your taxes for the year, use the Income Tax Calculator. If you need to calculate what a lump of money is worth now or in the future, you can use the Finance Calculator.