What Are Dividend Aristocrats?

In this article, you’ll:

- Learn why dividend investors sometimes favor dividend aristocrats.

- Learn about other classifications of dividend growth stocks.

- Gain a strong understanding of not only what a dividend aristocrat is, but who they are with plenty of examples of the companies that populate the list.

- Discover how to invest in dividend aristocrat stocks.

Dividend Aristocrats: How Dividend Classifications Work

Dividend aristocrats are not the only stocks that matter to dividend growth investors. Dividend aristocrat status alone does not make a stock a sound income-producing investment.

Look at companies not as far along in their dividend-paying lifecycle when researching stocks with a track record of dividend increases.

Dividend Classifications

As of April 2023, there are 371 dividend achievers. These are companies that have increased their annual dividend payments every year for at least 10 years in a row.

These companies must trade on either the New York Stock Exchange or Nasdaq and meet a three-month trading volume average of $1 million or more.

Next comes dividend contenders. In serious contention for dividend aristocrat status, these 343 companies (as of April 2023) have boosted their yearly dividend payment every year for between 10 and 24 consecutive years.

At first glance, this can be confusing. However, it’s anything but.

- A company can be a dividend aristocrat and a dividend achiever at the same time. Because 10 years or more is, in some cases, 25 years or more.

- However, with the upper limit of 24 straight years, the dividend contender list is smaller than the dividend achiever list because it does not include dividend aristocrats.

Dividend Aristocrats: The Coveted Dividend Classification Status

While it makes sense to seek companies on the verge of dividend aristocrat status, dividend aristocrats remain the cream of the dividend crop. However, to be part of this list a company must meet requirements beyond the 25-year or more annual dividend increase streak.

In addition to the 25-year or more requirement, dividend aristocrats must be S&P 500 Index stocks with a market capitalization of at least $3 billion. They must also have daily average trading volume of $5 million or more in the three months preceding a quarterly review of the dividend aristocrat list.

As of April 2023, 68 stocks qualify for dividend aristocrat status.

Another category, known as dividend champions, includes dividend aristocrats, but also companies who have increased their annual dividend payments for at least 25 consecutive years, but do not meet the S&P 500, market cap or trading volume rules.

Given the less rigid requirements, there are more stocks on the list. As of April 2023, 131 names qualify for the dividend champion designation.

Finally, we call an exclusive group of 39 companies (as of April 2023) dividend kings. These companies have increased their annual dividend payments every year for at least 50 years. Because they also do not have to meet the S&P 500 inclusion, market cap or trading volume rules, not all dividend kings are aristocrats.

As most investors consider the most stringent dividend aristocrats’ list the cream of the crop, this guide focuses on dividend aristocrats. For a thorough look at dividend contenders, see the above-linked guide on companies on the precipice of dividend aristocrat status.

Dividend Aristocrat Examples

Let’s start with the 28 dividend kings that are also dividend aristocrats.

After you look at the list, we’ll make key distinctions between the stocks. The second number in parentheses is the company’s current annual dividend increase streak, as of April 2023.

- Dover Corp (DOV) (67)

- Genuine Parts Company (GPC) (67)

- Procter & Gamble (PG) (67)

- Emerson Electric (EMR) (66)

- 3M Company (MMM) (65)

- Cincinnati Financial (CINF) (63)

- Coca-Cola Company (KO) (61)

- Colgate-Palmolive (CL) (61)

- Johnson & Johnson (JNJ) (61)

- Lowe’s Companies (LOW) (60)

- Nordson Corp (NDSN) (59)

- Illinois Tool Works (ITW) (58)

- Hormel Foods (HRL) (57)

- Federal Realty Investment Trust (FRT) (55)

- Stanley Black & Decker (SWK) (55)

- Target (TGT) (54)

- Sysco (SYS) (52)

- Abbott Laboratories (ABT) (51)

- Abbvie (ABBV) (51)

- Becton, Dickinson & Company (BDX) (51)

- Kimberly-Clark (KMB) (51)

- Leggett & Platt (LEG) (51)

- PepsiCo (PEP) (51)

- PPG Industries (PPG) (51)

- W.W. Grainger (GWW) (51)

- Nucor Corp (NUE) (50)

- S&P Global (SPGI) (50)

- Walmart (WMT) (50)

Impressive list. And a nice group to pick from if you aim to be a dividend growth investor. However, you can make key distinctions between even this elite group of dividend aristocrats, doubling as dividend kings.

Consider this example.

As our guide to dividend growth investing details, the amount by which a company increases its dividend each year matters.

Among the dividend kings, and all dividend aristocrats for that matter, Lowe’s has the most impressive 5-year annual average dividend increase rate at 20.7%.

Between 2022 and 2023, Lowe’s upped its yearly payout by 31.3%, from $3.20 to $4.20, which puts it in the top spot on that statistic for dividend kings.

By contrast, the dividend king with the longest stretch of increases – Dover Corp at 67 years – has a long track record of relatively small increases of just a couple to a few cents per year.

The company’s most recent move took its annual dividend from $2.00 to $2.02, an increase of just 1.0%. Over the last five years, Dover has increased its annual dividend by an average of only 1.4%.

While this doesn’t necessarily mean you shouldn’t buy Dover stock or you should buy Lowe’s instead of Dover, it does mean Dover’s dividend growth pace isn’t nearly as impressive as Lowe’s. This is a key point of consideration when constructing a dividend growth portfolio.

As for the remaining dividend aristocrats, let’s look at a couple more names and make examples out of them.

Of all the current dividend aristocrats, Essex Property Trust (ESS) pays the largest annual dividend at $9.24, as of April 2023. As with most dividend stocks, Essex makes quarterly dividend payments ($2.31 each) to shareholders. However, there is a reason for this relatively out-sized distribution.

Essex is a real estatement investment trust, known shorthand as a REIT. SEC and IRS regulations require REITs to return 90% or more of their taxable income to shareholders as dividends. This mandate doesn’t make Essex’s dividend any less impressive.

The company started paying a dividend in 1994. And it has increased that dividend annually – every single year – over the 29 years since 1994. In 1995, Essex paid out $1.685 in dividends.

In 2023, it will pay out $9.24, good for a roughly 448% increase between 1995 and 2023. Over the last ten years, Essex has increased its dividend payment by an annualized average of approximately 7%.

This pace of dividend increases – coupled with the aforementioned REIT requirement – makes it clear that Essex has experienced robust income growth over this period. As revenue and profits grow, dividends often grow commensurately. With REITs such as Essex, they have to. It’s the law.

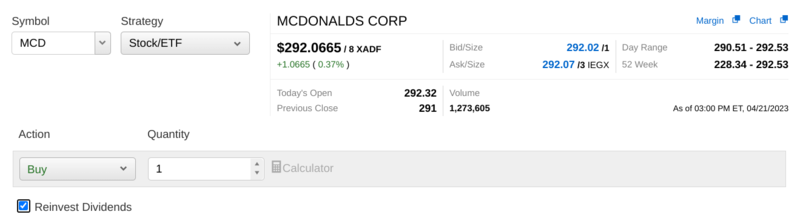

Now, consider a name everyone knows – McDonald’s (MCD). As of April 2023, McDonald’s pays an annual dividend of $6.08. This works out to quarterly payments of $1.52.

If you own 100 shares of MCD stock, all else equal, you can expect to receive $152 in dividend income each quarter. McDonald’s has increased its dividend for 47 consecutive years.

Between 2022 and 2023, it increased its payment 10.1%. The company has managed to do this despite negative revenue growth in the same timeframe. Sometimes this is a red flag.

Sometimes not. The answer often comes down to a metric known as payout ratio. See our guide to dividend payout ratios to learn about this metric and how to apply it to your research.

Spoiler alert: McDonald’s is mostly okay on this measurement.

Dividend Aristocrats: How To Invest In Them

Most investors will buy dividend aristocrats the same way they buy any type of dividend-paying or non-dividend paying stock. You will likely buy dividend aristocrats individually in your brokerage account or as a basket of stocks via an exchange-traded fund, commonly known as an ETF.

Our general guide to dividend ETFs and our guide to the best dividend ETFs to buy now provide comprehensive looks at the ins and outs of dividend ETF investing. In this guide, you’ll learn the basics of an individual stock as well as the ETF approach.

When you buy a stock that pays a dividend in your brokerage account, you’ll generally see something like this:

If you’d like to “reinvest dividends,” which is the key component of dividend growth investing, be sure to check the box next to reinvest dividends (lower left hand corner of the example above).

Some trading platforms might refer to it as dividend reinvestment. Little variations like this don’t change the meaning. Reinvest means when you receive a dividend payment, your brokerage will automatically purchase more shares of the stock for you with that dividend.

If you prefer to streamline your dividend growth investing, look to ETFs.

As our above-linked ETF guides explain in great detail, ETFs invest in either a basket of stocks that, generally speaking, mimic an index of stocks (such as the S&P 500 or Nasdaq 100) or follow a specific theme.

For example, the ProShares S&P 500 Dividend Aristocrats ETF (NOBL) invests in the stocks that make up the S&P 500 Dividend Aristocrats Index. Therefore, NOBL’s holdings are identical to that of the formal index. And the returns are virtually identical.

As far as themes go, more specialized dividend ETFs hold assortments of stocks that have high yields or emanate from a certain part of the world (international ETFs). Quite a few of these thematic ETFs exist. Here again, our dividend ETF guides provide comprehensive overviews.

You purchase shares in ETFs the same way you do stocks. Through your brokerage account with the option to reinvest dividends.

FAQs

Where can I find a list of dividend aristocrats?

There’s a website that keeps an updated list of dividend aristocrats. You can access it and download a spreadsheet of these stocks here.

What other household names are dividend aristocrats?

In addition to McDonald’s there are two many to name. However, in addition to McDonald’s and Lowe’s, Target (TGT), Chevron (CVX) and Walgreens (WBA) are among the most well-known.

Will I discover names I don’t know among the dividend aristocrats?

Probably. Essex Property Trust isn’t necessarily a household name. With a large number of aristocrats in sectors such as heavy industry (e.g., Illinois Tool Works (ITW)) and basic materials (Air Products & Chemicals (APB)), you’re sure to stumble on some refreshingly new names to add to your portfolio.

Should I own dividend aristocrats forever?

That’s up to you and really depends on your goals, investment style and personal financial situation. That said, a buy-and-hold philosophy tends to get the most out of the dividend growth investing approach.

Do dividend aristocrats ever cut their dividend?

Absolutely. Though it’s relatively rare, it happens. One of the most glaring examples is AT&T (T). After increasing its dividend payment for more than 35 years, the company ran into some issues amid its spinoff of the WarnerMedia division and decided to cut its dividend payment.

You mentioned companies on the verge of dividend aristocrat status. Can you preview one for us?

Sure. Apple (AAPL). We feature Apple in our guide to companies that will likely attain dividend aristocrats status one day. While Apple has only increased its dividend for 11 straight years, as of April 2023, there’s no reason to believe it will stop given its revenue growth, consistent profitability, huge cash position and healthy payout ratio.

Can you turn dividend reinvestment on and off?

Yes, you can. While the way the page looks differs between online brokerages, there will be an account page that lists your holdings. Next to dividend stocks and ETFs, there is usually a switch you can turn on and off – as often you please – to switch between reinvesting dividends and receiving them as cash payments.

Conclusion

Dividend stocks are a great way to generate income in your portfolio. Companies with a track record of increasing their dividend payments often make the best dividend investments. Known as dividend growth stocks, dividend aristocrats form a group of the most well-respected and formidable dividend payers.

There’s a reason why ProShares uses the ticker NOBL for its dividend aristocrats ETF. It’s short for noble.

As this guide shows, it always pays to look under the hood of a company’s dividend and consider related metrics before making your investment decision.