How To Receive Dividend Income Every Month

Investing can be stressful, and at times unpredictable. You can aim to achieve a relative sense of calm, balance and predictability through dividend growth investing. To do so, it pays to go beyond merely investing in random stocks that pay dividends.

Frequency Of Dividend Payments

Most dividend-paying stocks make their payouts to shareholders quarterly or monthly. Occasionally a company will issue a special, one-time dividend, but it’s usually best to not chase these dividends.

Instead, focus on receiving regular dividend income. You can best execute this objective — and strive for a diversified portfolio — using stocks that pay dividends quarterly, or four times a year.

Monthly Dividend Stocks

We dive deep into monthly dividend stocks (with examples) elsewhere. For the purpose of this article know that you can receive monthly dividend income simply by investing in stocks that pay their dividends monthly. While this approach can be easy and effective, it comes with a caveat.

Of the 60 companies that pay monthly dividends, as of April 2023, a majority focus on owning, operating and/or financing different types of real estate.

While you can achieve some diversification in real estate by investing in a basket of these stocks, known as REITs, you cannot achieve broad diversification if you focus too heavily on one sector.

Therefore, we focus on the more common quarterly dividend payers that span pretty much every business sector you can imagine.

Creating A Portfolio With Monthly Dividend Income

Monthly dividend income isn’t hard to come by. All you have to do is get familiar with finding out when companies pay dividends and how to structure a portfolio that generates dividend income in all 12 months of the year.

To receive monthly dividend income, all you need to do is stagger three stocks that pay their dividends on quarterly schedules.

It’s easy to obtain this information. Visit the company’s investor relations website and look for a tab that says “stock information” or something similar. Find the link to “dividend history.”

Using our first example stock, Kimberly-Clark (KMB), it looks like this:

After you click on “stock information,” most IR pages reveal a “dividend history” link.

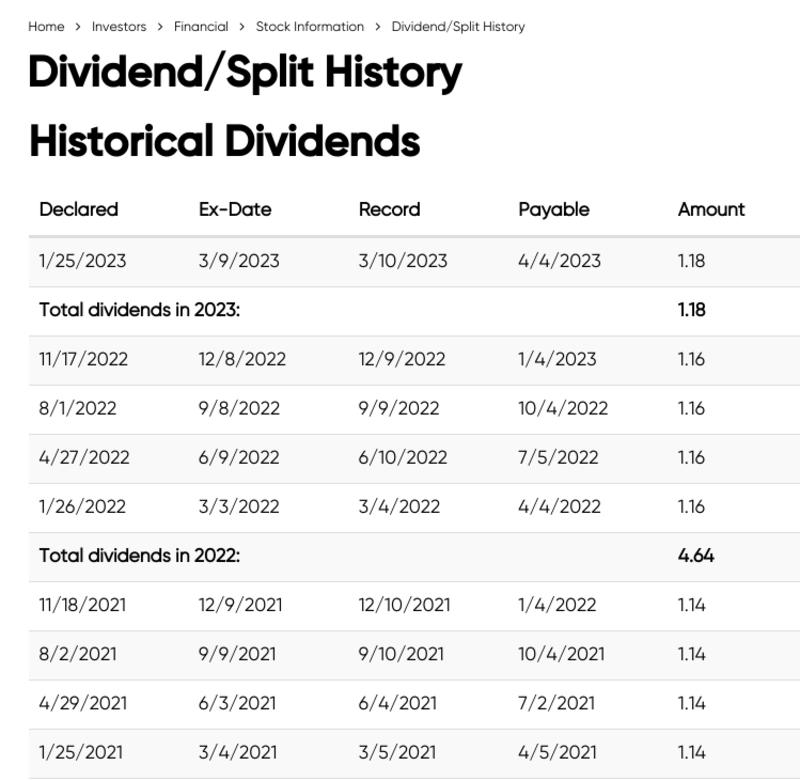

After clicking on that tab, you’ll see a chart listing all of the company’s historical dividend payments. KMB pays its dividend quarterly in January, April, July, and October every year.

From here, you simply have to find stocks among the ones on your watchlist that pay dividends on the following schedules:

- February, May, August, and November

- March, June, September, and December

We’ll give you a headstart.

Apple (AAPL) is a crowd favorite that pays its dividend in February, May, August, and November.

Another blue chip name, McDonalds (MCD), makes its quarterly dividend payouts in March, June, September, and December.

You can look beyond official investor relations sites to reputable sources to find dividend history and payout schedule details. For MCD, we used the trustworthy Nasdaq website.

If you held 100 shares each of KMB, AAPL and MCD in 2022, you would have received $464 in dividend income from KMB, $91 from AAPL and $566 from MCD for a total of $1,121 in dividend income from these three stocks alone. Average it out over the year and you would have collected $93.42 a month in dividends from KMB, AAPL and MCD.

As you add more dividend stocks to your portfolio, add to existing positions and let the power of dividend reinvestment take hold, you can generate a handsome source of consistent monthly income to continue reinvesting or to help pay your living expenses.

FAQs

Is there a website that lists the different payout schedules of dividend stocks?

Not one we trust. To ensure accuracy, start with investor relations sites and reputable names such as Nasdaq.

What is a “dividend aristocrat”?

A dividend aristocrat is a company that has increased its dividend payment every year for at least 25 consecutive years. For a full list of the requirements for dividend aristocrat status, as well as other dividend increase categories, see our comprehensive guide on the subject.

Is Apple a dividend aristocrat?

No, not yet. As of April 2023, Apple has increased its dividend annually for 11 straight years. Apple’s track record isn’t as long as Kimberly-Clark’s (52 years) or McDonalds’ (46 years), in part because it is a hyper growth tech company. These companies tend to not pay dividends as early in their lifecycle as slower growth names such as KMB and MCD do.

What does reinvest dividends mean?

When you receive a dividend you can elect to take the payout as cash or use it to purchase new shares of the company’s stock. We refer to this latter option as reinvestment.

Can a company change its dividend payment schedule?

With board approval, yes. However, most companies tend to pick a schedule and stick with it to give their shareholders a sense of consistency and control over their dividend income.

Do companies ever stop paying dividends?

Sometimes. This is often a sign of trouble, such as lagging revenue and weakening profits. This is why it’s critical to (a) maintain a diversified portfolio so trouble at one company doesn’t crush your returns, and (b) only invest in high-quality stocks that pay reliable and growing dividends. The links throughout this guide can help you with this aspect of dividend growth investing.

Conclusion

It definitely takes time to build a large enough base to live off of, but as our example shows, you can start earning meaningful income from dividend stocks right away. If you stagger payout schedules strategically, your dividend stock portfolio can be a consistent source of monthly income.

By picking dividend aristocrats such as Kimberly-Clark and McDonalds, as well as companies poised to become aristocrats, like Apple, you increase your chances of having not only a consistent income source, but one that’s reliable and grows as these strong companies regularly increase the size of their dividends.